Trusted by 100+ Canadian small business owners

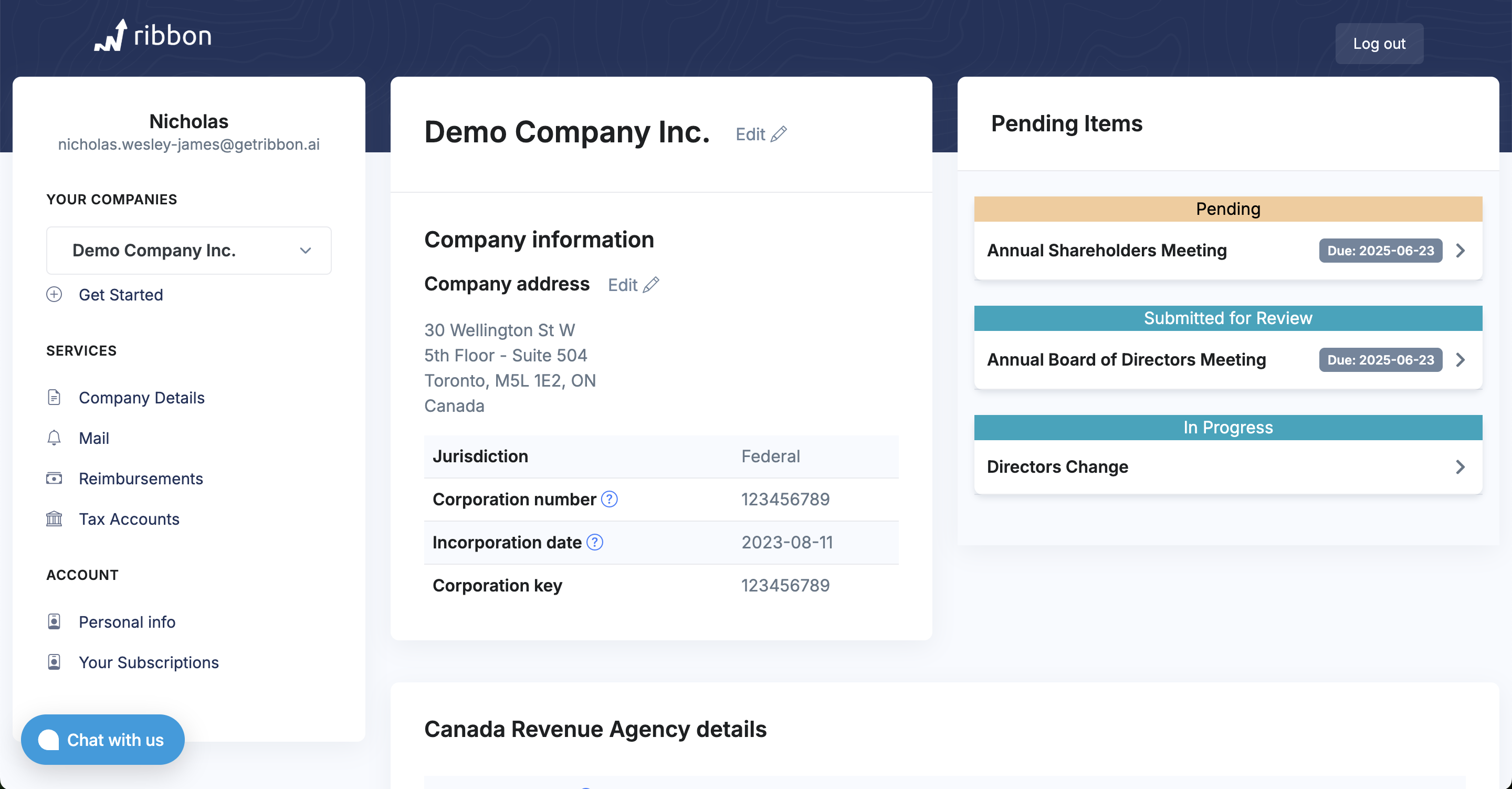

These folks are absolute gems - Nicholas and Vishal are both valued resources and an integral part of our organization, we couldn't have achieved what we've done in such a short amount of time without them. We're very pleased. Definitely have our recommendation for bookkeeping, taxation, regulatory and compliance. Their portal is beyond nifty too - keeping us up-to-date on compliance.

Wakey Internet