Humans + Software Working on Your Finances

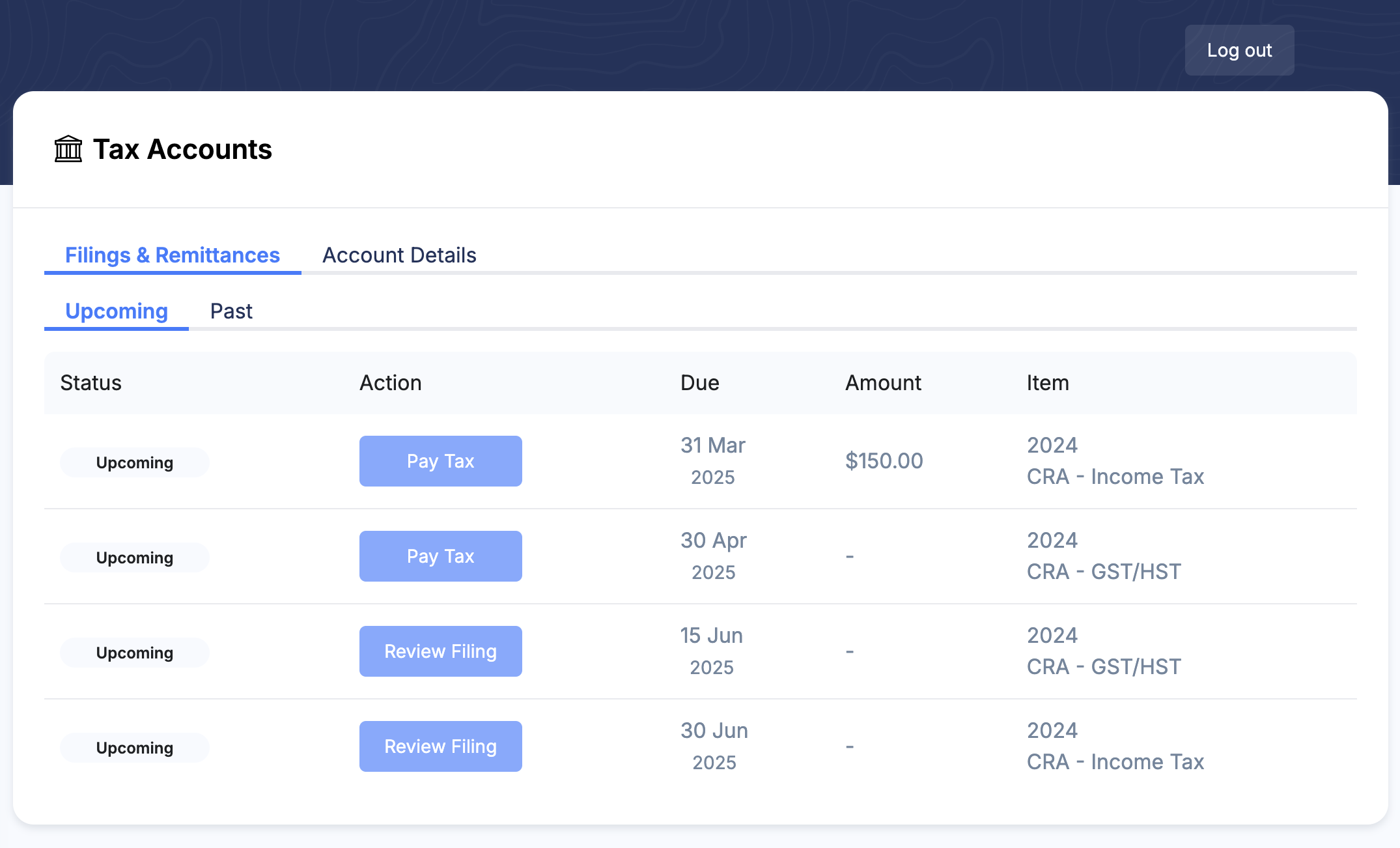

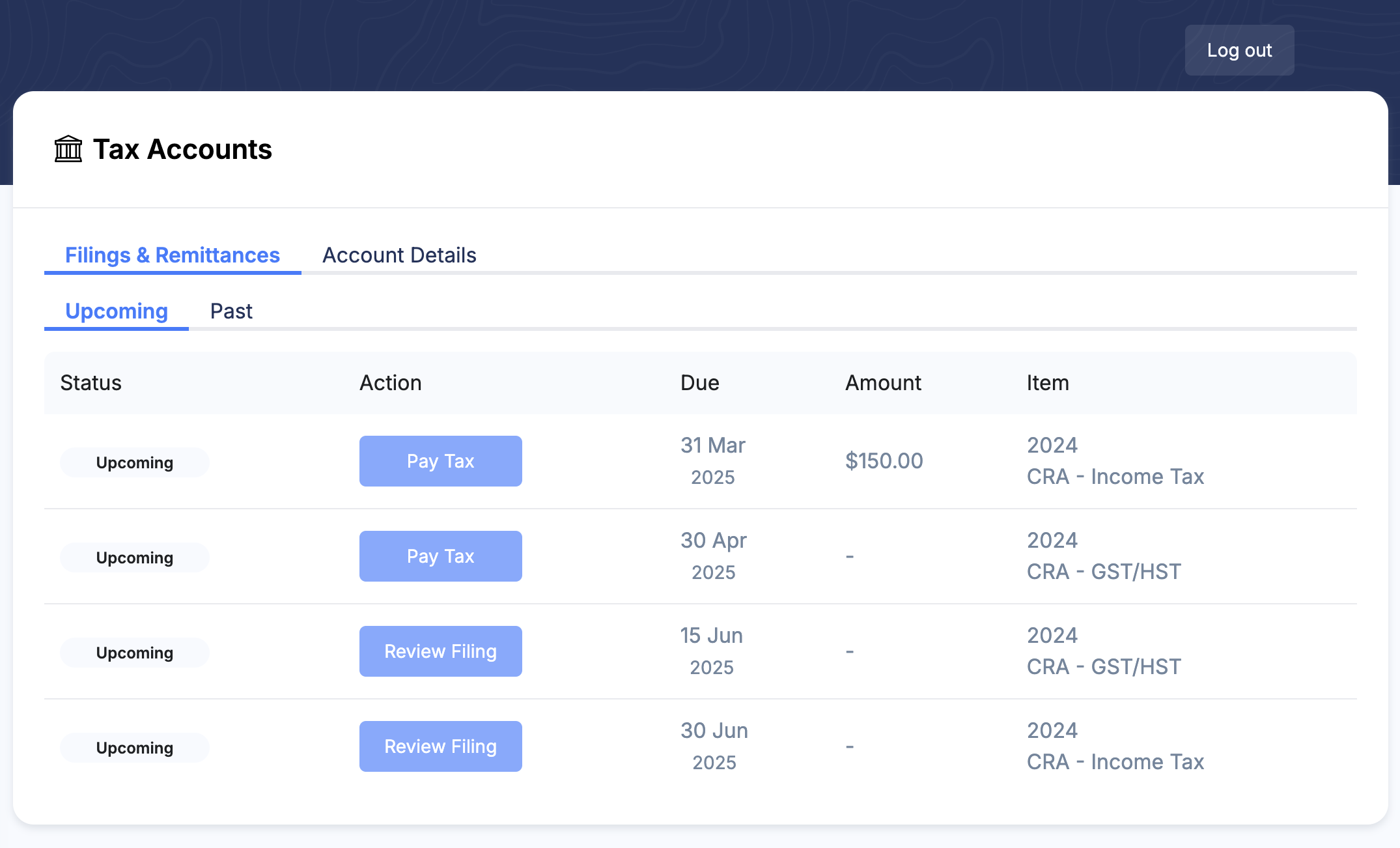

We built a portal to help keep track of your finances.

- Track CRA deadlines.

- Maximize self-employed deductions, including Home Office, Internet, Cellphone and Personal Vehicle.

- Backed up with human support.

We keep your books clean, your taxes filed, and your business compliant — so you can focus on running your business.

Starting at $275/month with Ribbon Complete

“These folks are absolute gems - Nicholas and Vishal are both valued resources and an integral part of our organization, we couldn't have achieved what we've done in such a short amount of time without them. We're very pleased. Definitely have our recommendation for bookkeeping, taxation, regulatory and compliance. Their portal is beyond nifty too - keeping us up-to-date on compliance.”

We work with Canadian entrepreneurs who are focused on growth — not admin. Whether you're a consultant, eCommerce operator, small business, or professional service provider, Ribbon keeps your back office organized and your CRA filings on time.

We built a portal to help keep track of your finances.

We connect to your bank, review your business needs, and get your books started.

Transactions are categorized, reconciled, and reviewed by our team.

You'll receive a clean set of books and a timely T2 corporate tax filing.

We track your deadlines, keep your records organized, and support you year-round.

Catch-up bookkeeping available starting at $250